Reply to Danya Ruttenberg on Jews and Usury

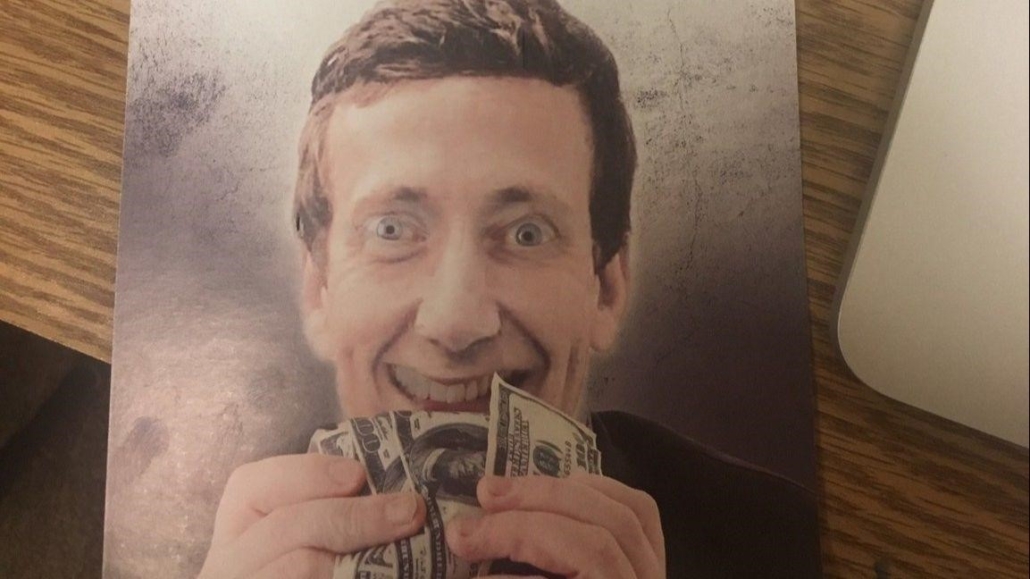

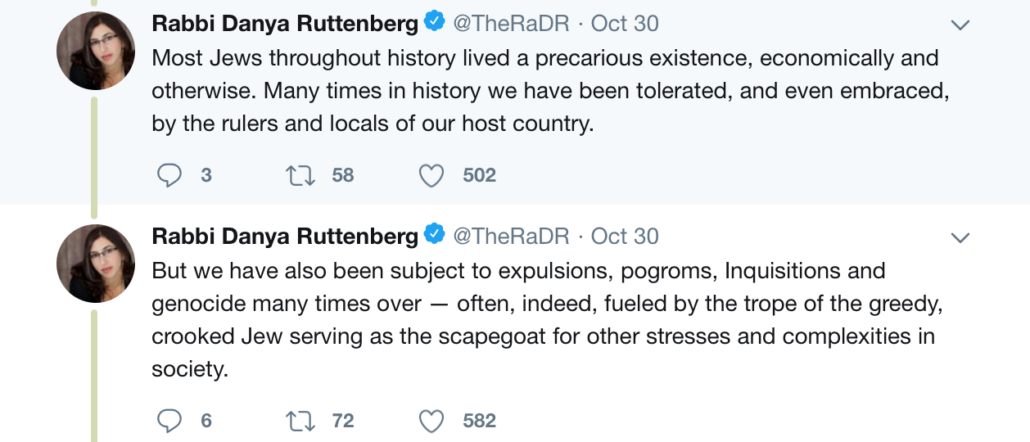

I must object to Danya Ruttenberg’s recent Twitter thread on Jewish usury. The thread appears to have been prompted by a mailer sent out by Connecticut GOP State Senate candidate Ed Charamut, which shows Jewish opponent Matt Lesser clutching a fistful of cash. Criticism from Jews was almost immediate, with familiar claims that the piece played into “harmful anti-Semitic stereotypes” of Jews as greedy, exploitative, and untrustworthy. Charamut initially attempted to defend his use of the image and accused Lesser of “using the Democrat playbook of identity politics to hide from his record.” He insisted the image was only illustrating his belief that Lesser would vote to increase taxes and more government spending.

Unfortunately, but predictably, Charamut quickly caved and has now issued a groveling apology for his campaign flier, pleading: “It is clear now that the imagery could be interpreted as anti-Semitic, and for that we deeply apologize as hate speech of any kind does not belong in our society and especially not in our politics.” He then apologized specifically to Lesser, the Jewish community and “anyone who found the mailer to be anything other then a depiction of policy differences between the two candidates.” Lesser himself has claimed the pamphlet employs imagery used to depict Jewish people going back hundreds of years.”

At issue here is the fact it’s now basically forbidden, or considered highly suspect, to negatively discuss or depict the subject of Jews and money in any context — even if you object to the fiscal policies of your Jewish political opponent. Supporting this soft censorship is a quite distinctive Jewish historical narrative that is really nothing more than a tapestry of politicized myths. These myths act as something like a cultural-psychological shield, deployed instinctively, along with a special vocabulary (“trope!”, “canard!”, “stereotype!”), by strongly-identified Jews against all incoming criticisms.

Danya Ruttenberg is one such strongly identified Jew, and her Twitter thread in response to the Charamut-Lesser incident is a classic example of the cultural-psychological shield. Normally these deployments are so commonplace and predicable that they merit little comment. Ruttenberg’s statement, however, has achieved almost 2500 retweets and over 3000 likes in a little over 48 hours. Some response, I feel, is required.

Ruttenberg is apparently a rabbi and feminist author and has been named one of The Jewish Week‘s “36 Under 36” in 2010 (36 most influential leaders under age 36), and was also named one of the top 50 most influential women rabbis by The Jewish Daily Forward. In certain respects she is far from Orthodox, but she is a very strongly identified leftist Jew and exemplifies, in many respects, trends and attitudes in Diaspora Judaism. Her unabashed feminism, ‘anti-racism,’ and leftism has contributed to a certain appeal outside Judaism, and she enjoys a Twitter following of over 43,000. It was for this not insignificant audience that she attempted to contextualize the Charamut-Lesser incident with an apologetic narrative on Jews and usury. Why she focused specifically on the issue of usury in response to the incident is unclear (Lesser is not a moneylender and he is not depicted or referenced in relation to debt in the Charamut flier), unless one assumes that on some level Ruttenberg acknowledges the fact that Jews have, in the past and present, maintained what can only be termed a special or extraordinary relationship with money. As such, Ruttenberg deploys the classic Jewish apologetic narrative attempting to explain this relationship, and begins, in erroneous but predictable fashion, with Jewish moneylenders in medieval Europe.

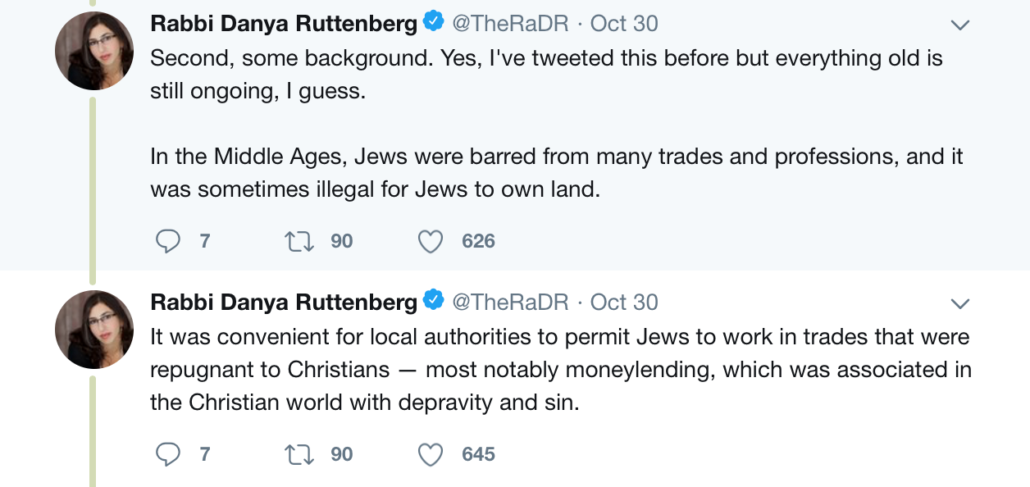

The first problem with Ruttenberg’s narrative is that she begins with Jewish moneylending in medieval Europe. This is part of a strategy I have elsewhere described as a “cropped timeline explanation.” Essentially, when confronted with the question of why Jews have generated such animosity in history, across such a broad geographical area, and amidst such a variety of religious cultures, Jews resort to a process of historical gerrymandering. To accept the full breadth and weight of the historical context leaves Jewish behaviour as the only logical explanation for anti-Semitism. Since this is culturally, religiously, and psychologically unacceptable to Jews, they have long resorted to simply ignoring vast swathes of evidence. This most often involves beginning and ending their explanation for anti-Jewish animosity with a timeline most befitting the meme of innocent Jewish victimhood and predatory European Christianity. As such, all Jewish explanations of anti-Semitism essentially begin with medieval Christendom, and omit or downplay any historical evidence of Jewish behaviour and anti-Jewish cultural currents outside this time frame, or the historical narratives that may follow from it. This process will be described in more detail below, but it should suffice to state here that the special relationship between Jews and money preceded medieval Christianity.

It is a matter of clear historical record that the special relationship between Jews and money preceded medieval Christianity. Jews have settled among European host populations since ancient times. The oldest communities were in the urban centers of the Mediterranean, and a list of Jewish colonies in this area can be found in the First Book of Maccabees. In the early Roman empire clusters of Jews could be found as far north as Lyon, Bonn and Cologne.[1] The economic nature of these communities was uniform, and similar to those in the East. Even prior to the Talmudic era, c.300–500 A.D., Jews had developed a strong interest and aptitude in commerce and banking. From its origins, the Jewish involvement in these spheres was regarded by host populations as malevolent and exploitative. In one of the earliest examples, a papyrus dated to 41 A.D., an Alexandrian merchant warns a friend to “beware of the Jews.”[2] During the fourth century, Alexandria witnessed a number of anti-Jewish riots, almost all of them provoked by accusations of economic exploitation.

In other words, Jewish economic activity was deemed highly problematic by host populations at least one thousand years before Ruttenberg begins her cropped timeline explanation for the “trope” of Jews and usury — an economic activity that had not only condemned as unethical by Christian theologians, but by Aristotle and large numbers of Greek and Roman legislators.

Between the fifth and tenth centuries, Jewish trading posts took hold across Europe, from Cadiz and Toledo to the Baltic, Poland, and Ukraine. This extensive network afforded the Jews an almost total monopoly in the exchange of currency and information. Islamic and Christian civilizations during this period were bitterly opposed and traders from either faction were reluctant to carry goods into rival territory. Jews, enjoying relative tolerance from both civilizations, were able to carry goods from the Middle East into Europe, where Carolingian elites were particularly fond of purchasing luxury goods from Arab lands via Jewish merchants. Similarly, Jews were strategically positioned to overcome the legal obstacles of both civilizations to usury, an economic area they had refined almost to an art form in Babylon — as evidenced in the very large amount of commentary on moneylending in the Babylonian Talmud.

During the Carolingian Dynasty (c. 714 – c.877), the Jewish population of Northwestern Europe evolved from a scattering of individual international traders to growing communities of local traders. The shift to local trade enabled the Jews to acquire an influential middleman role in European society, to which they added widespread engagement in credit operations. On this foundation of growing economic influence, the later Carolingian period also witnessed the development of the first symbiotic relationships between Jewish finance and European elites. This granted significant privileges and protections to Jews, who soon acquired elite status themselves. One of the first examples of such a relationship emerged in the 810s, when Agobard (c.779–840), the Archbishop of Lyon attempted to restrict the financial activities of Jews in his locality, and was confronted with royal power. Perhaps even more so than when Muslims invaded Spain in 711, when “the Jews helped them overrun it,”[3] the silencing of Agobard may be regarded as the birth of the Jews as a hostile elite in European society. Certainly it was the first major political victory for the taboo on claims regarding Jewish influence.

Encouraged by the successes of financial-political pioneers like those in Lyon, significant numbers of Jews from southern Europe began a steady northern migration. The point here is that Jews were not pre-existing in large numbers in northern and western Europe and merely moved into moneylending due to a prohibition on other occupations or the owning of land. It was not a case, as Ruttenberg argues, of it being “convenient for local authorities to permit Jews to work in trades that were repugnant to Christians.” Rather, Jews moved to medieval Europe specifically in order to engage in moneylending and the lucrative trade of goods on credit at interest. Many gathered in the Rhine basin, forming the nucleus of what would later come to be known as ‘Ashkenazi’ Jewry.

Expansion from there was rapid. A colony of Jewish financiers reached England in 1070, following on the heels of the Norman Conquest four years earlier. B. Lionel Abrahams used vast quantities of archival evidence in his 1894 Arnold Prize-winning article on “The Expulsion of the Jews from England in 1290,” and was able to conclude on the basis of this evidence that when the Jews first settled in England “they brought with them money, but no skill in any occupation except lending it out at interest.”[4] Another article states that there is no evidence, among this abundant literature, “to suppose that the English Jews of this period got their living in any considerable numbers in any other art or craft. … It is therefore probable that the capital with which the community started in the country was very considerable.”[5] Headquartered in London, the Jews of England mirrored their counterparts elsewhere on the continent in that they became “a tightly knit class of financiers. From the start they managed to associate closely with the kings in their operations, turning over to the royalty the notes of defaulting debtors in return for a share of the sums due. They were the ‘king’s men,’ vassals of a special kind, since they were the chief source of their suzerain’s revenues.”[6] The foundation of the Jewish relationship with European elites was thus a general confluence of financial and political ambitions. The primary victims would be the European masses.

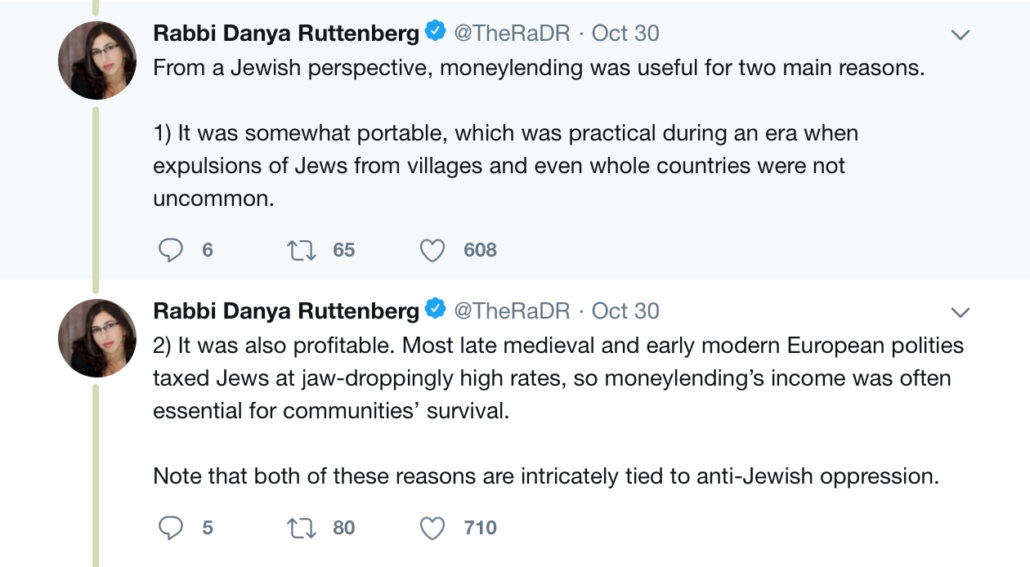

The curious thing here is that Ruttenberg explains in her next two tweets that moneylending was very attractive to Jews, and explains that cash was more portable than land and that usury was very profitable. So, taken together, her first four tweets amount to the argument that Jews were mercilessly forced against their best intentions into an occupation that they found wildly convenient, profitable, and powerful. Quite the silver lining. Setting aside the possibility that Ruttenberg is simply a liar, there is clearly an issue of self-deception at play here in the denial of the well-established fact that Jews enjoyed moneylending and deliberately developed their demographic and cultural presence in Europe at the nexus of the financial and the political.

Of course, Ruttenberg can’t help but end with a return to the lachrymose narrative of Jewish victimhood. These Jews, forced to become wealthy and powerful via loans, were taxed at “jaw-droppingly high rates” and their way of life was “tied to anti-Jewish oppression.”

In reply, for most of the medieval period Jews weren’t subject to high levels of taxation. Elman, having examined the medieval taxation rolls of England, writes that “apart from the quasi-regular and normal legal sources of income, which the English as much as the Jews were required to pay, the king claimed from a Jews a number of occasional contributions, especially loans and tallages [i.e., taxes levied by a medieval lord on dependents]. In the thirteenth century, which is the vital period for our purpose, the loans were insignificant in number and amount [emphasis added].”[7] Further, there “is no evidence of the levy of any collective tallage upon them until the year 1168, and then the number did not exceed 5,000 marks.”[8] When the tallages were brought in, they only applied to land that Jews had seized in lieu of the unpaid loans of the barons — high taxation in these instances were just a fiscal sleight-of-hand to allow Jews to seize land on the forfeited loans of the barons and then pass them to the Crown as part of the overall deal underpinning their settlement. Further, Jews were excused from Crown taxes[9] and unlike the Christian population, in their movement around the country transacting business Jews were “free of all tolls and dues.”[10]

On the matter of “anti-Jewish oppression,” the Jewish penetration of European society was a risky venture but one that Jewish populations evidently felt was worth the gamble. No Jews were ever forced to settle in a European country, but still they came and still they expanded. They were aware that as non-Christians and as masters of debt they would generate hostility in the general population. Indeed, these considerations formed an important aspect of their bargaining for charters — agreements drawn up between Jews and European elites that laid down the terms of residence, levels of protection, and financial rewards that would make it worthwhile for Jews to settle. For example, in 1084, Jews were given a defensive wall around their settlement quarter in the Rhineland town of Speyer in fulfillment of promises made in their charter.[11] Some of the oldest houses still standing in England were originally built on the orders of Jews, their longevity owing to the fact that Jews possessed the wealth to build homes with a generous use of stone for security.[12] The Jewish move into Europe was thus predicated upon an understanding that Jews would be hated but untouchable, reviled but rich, merciless but unaccountable.

Compare Benzion Netanyahu’s comment:

It was primarily because of the functions of the Jews as the king’s revenue gatherers in the urban areas that the cities saw the Jews as the monarch’s agents, who treated them as objects of massive exploitation. By serving as they did the interests of the kings, the Jews seemed to be working against the interests of the cities; and thus we touch again on the phenomenon we have referred to: the fundamental conflict between the kings and their people—a conflict not limited to financial matters, but one that embraced all spheres of government that had a bearing on the people’s life. It was in part thanks to this conflict of interests that the Jews could survive the harsh climate of the Middle Ages, and it is hard to believe that they did not discern it when they came to resettle in Christian Europe. Indeed, their requests, since the days of the Carolingians, for assurances of protection before they settled in a place show (a) that they realized that the kings’ positions on many issues differed from those of the common people and (b) that the kings were prepared, for the sake of their interests, to make common cause with the “alien” Jews against the clear wishes of their Christian subjects. In a sense, therefore, the Jews’ agreements with the kings in the Middle Ages resembled the understandings they had reached with foreign conquerors in the ancient world. (Netanyahu 1995, The Origins of the Inquisition in 15th-Century Spain, 71–72)

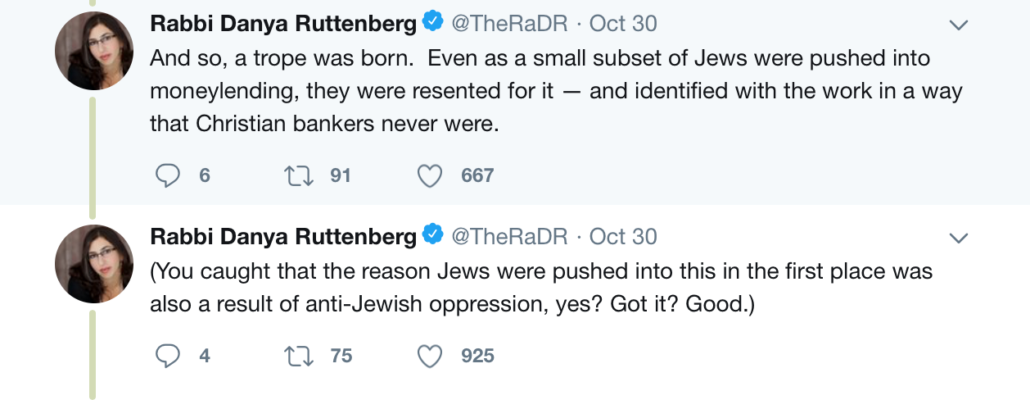

Perhaps the most egregious falsehood in Ruttenberg’s tweet thread is her claim that “only a small subset of Jews were pushed into moneylending.” First, it should by now be clear that Jews were not “pushed” into moneylending. Second, the numbers engaged in moneylending were not “a small subset.” One historian has pointed out that there is no evidence, among the abundant literature on medieval English Jewry, “to suppose that the English Jews of this period got their living in any considerable numbers in any other art or craft. … It is therefore probable that the capital with which the community started in the country was very considerable.”[13] In the thousands upon thousands of pages of documents we have on this community (the residential data, the taxation information, the details of their personal accounts etc.), we don’t find a professionally diverse and dispersed population, but instead a close-knit, inter-related, and extremely well-organized group of money-lenders and financiers.

Ruttenberg’s claim that only a small subset of Jews were engaged in moneylending and her claim that Jews were treated differently from “Christian bankers” are actually linked in more ways than one. Some excellent research has recently been carried out on the context of Jewish expulsions in medieval Europe (and the expulsions of usurers more generally) by Harvard’s Rowan William Dorin. Dorin’s 2015 PhD thesis, Banishing Usury: The Expulsion of Foreign Moneylenders in Medieval Europe, 1200–1450, is viewable here and is well worth the read, particularly his chapter on the background to the expulsions of Jews. In May 2016, Dorin published a development of the ideas in a chapter in Law and History Review, “‘Once the Jews have been Expelled:’ Intent and Interpretation in late Medieval Canon Law.”[14] The major conclusions of Dorin’s meticulous work are that Jews were nothing more than a small and often incidental fraction of the overall expulsions of moneylenders from various areas of medieval Europe,and that most banishments targeted “Christians hailing from northern Italy. (PhD thesis, 3)” The expulsion of Jews from various European locations is revealed not as an expression of irrational anti-Semitism, but as a result of essentially judicial arguments that stressed the need for unanimous policies concerning usury. As Dorin notes, “one of the few constants of medieval papal attitudes towards the Jews had been a strong resistance to their expulsion.” (2016, 337).

This only began to change when usury, rather than Jews qua Jews, came under papal consideration. Early medieval usury legislation such as Usuranum voraginem was promulgated in response to the increasing presence of Christian moneylenders from northern Italy in the cities and territories of northern Europe, and it was on these Christian moneylenders that its sanctions fell (denial of lodging and expulsion within 3 months). Over time, however, both secular and ecclesiastical figures grappled with the wording of the legislation, which did not mention Christians specifically. Over time, a consensus grew that usury, whether Christian or Jewish, was a grave social ill, and the historical papal aversion of the expulsion of Jews was overturned. The majority of expulsions of Jews occurred not because of the deeds of a “small subset” of Jews, but because usurers of all descriptions were being expelled and Jewish communities were based almost exclusively on the trade in loans. They simply had to be removed in toto. This is only the briefest summary of Dorin’s work, and it really has to be read in full to be appreciated. It is, however, a powerful rejoinder from a Harvard PhD historian and medieval legal specialist to the pop pseudo-history advanced by Rabbi Ruttenberg and eagerly absorbed by those who really don’t know any better.

The latter part of Ruttenberg’s tweet depicted above really says it all in terms of the circular nature of the Jewish defensive narrative.[“You caught that the reason Jews were pushed into this in the first place was also a result of anti-Jewish oppression, yes? Got it? Good”] Ruttenberg basically engages in the familiar Jewish tactic of explaining every negative Jewish behaviour (that is, when any is admitted to) by pointing to oppression. “You oppressed us, so we did A.” “But why did we oppress you?” “Because we also did B.” But why did you do B?” “Because you oppressed us.” “But why did we oppress you in that instance?” “Because we also did C.” Ad infinitum.

Just in case anyone isn’t fully convinced by Ruttenberg’s thread, she wheels out some psychoanalytic jargon for her conclusion. The “trope” of the greedy, crooked Jew merely serves as the “scapegoat for other stresses and complexities in society.” I personally find it quite funny that one of these stresses and complexities remains household debt. I finally it equally strange that, despite it being two centuries since Jews achieved full political and economic “emancipation,” they are still utterly prolific as moneylenders and financiers. The founder and CEO of Avant Credit, one of America’s fastest growing online providers of consumer loans, is Al Goldstein. Goldstein is also behind SpringCoin, CashNetUSA, Dollars Direct, Enova International, Quick Quid, Pounds to Pocket, and On Stride Financial. Goldstein owns more than 10,000 properties foreclosed on Americans during the financial crash, an event in which his co-ethnics at Quicken Loans (Daniel Gilbert) and Roland Arnall (Ameriquest), played a major role. San Francisco-based moneylending operation LendUp, which has recently been forced to pay $6.33 million in refunds and fines for violating consumer finance laws. is operated by Sasha Orloff and Jacob Rosenberg. Chicago-based PLS Financial is owned and operated by Dan and Bob Wolfberg.

Jeffrey Weiss is the Jewish head of DFC Global Corp, which operates Money Mart, The Money Shop, PayDay UK, and PayDay Express. The head of EZCorp is the Jewish Australian Phillip Cohen. Among its American assets, Cohen’s EZCorp has a portfolio which includes EZ Pawn, Pawn Plus, Value Pawn and Jewelry, Premier Pawn and Jewelry, USA Pawn and Jewelry Company, Easy Cash Solutions, Jerry’s Pawn Shop, and CashMax Payday Loans. Internationally, it also owns Cash Amigo in Mexico, as well as the Cash Converters International Brand. EZ Corp has joined the U.K. feeding frenzy by offering the online payday lending “service” Cash Genie. As well as coming under criticism for charging annual interest rates of 2,986% on its loans, Cash Genie has been forced to repay money to its customers after the Financial Conduct Authority found that the company applied unauthorized charges to customer accounts and permitted customers to become indebted far beyond their means.

In the UK, Mr Lender advertizes its services under the motto “Your Friend Until Payday.” But who is Mr Lender? The founder and owner of the company is Adam Freeman, a member of the South West Essex and Settlement Reform Synagogue who was also selected for the U.K.’s version of The Apprentice. Even with new laws and restrictions, Mr Lender still charges 1,269.6% APR on his loans. Not very friendly.

But by far the most notorious “domestic” online moneylender in Britain is Wonga. It was the astonishing 5,853% rate on Wonga’s annual loans that finally prompted the British government to begin closing the loopholes which permitted the moneylender’s feeding frenzy on the British people. Wonga, which still charges annual interest rates of 1,509%, was founded by two South African Jews, Errol Damelin and Jonty Hurwitz. Both operated the company via the Virgin Islands in order to avoid paying tax. They were, however, very generous donors to Jewish causes like Jewish Care.

According to his Wikipedia entry, Damelin “grew up in a Jewish family where he attended the University of Cape Town. Following his graduation in 1992 he immigrated to Israel. He began his career working as a corporate finance banker at an Israeli bank that later merged into Israel Discount Bank.” He founded Wonga in 2007, with the company soon attracting criticism for “fraud and the exploitation of the most vulnerable in society.” Among the company’s practices was the forging of legal letters in order to terrorize customers into paying ever higher fees. Because such practices are completely illegal the company was later subject to a criminal investigation. Like a rat deserting a sinking ship, Damelin stepped down from his leadership at Wonga (retaining shares) just two weeks before the company was due to be hit with new regulations from the Financial Conduct Authority as well as a $4 million compensation demand. Wonga had yet to pay thousands of customers when it went bust in August 2018. Errol Damelin has since waded into obscurity while Hurwitz has reinvented himself as a creator of degenerate art that is then sold at inflated prices by the Jewish art-fad dictators, the Saatchi brothers. He calls this piece “Immigrant.” You couldn’t make it up.

I have to finish with the one true sentence from Ruttenberg’s thread — the first. “Everything old is still ongoing, I guess.”

I couldn’t put it better.

[1] P. Johnson, A History of the Jews (London: Weidenfeld & Nicolson, 1987), p.171.

[2] S. Baron (ed) Economic History of the Jews (New York: Schocken, 1976), p.22.

[3] Ibid, p.177.

[4] B. L. Abrahams, “The Expulsion of the Jews from England in 1290” Jewish Quarterly Review, 7:1 (1894), 75-100 (p.76).

[5] “The Jews of England in the Thirteenth Century,” Jewish Quarterly Review, 15:1 (1902), 5-22 (p.10).

[6] L. Poliakov, The History of Anti-Semitism, Volume 1: From the Time of Christ to the Court Jews (Philadelphia: University of Pennsylvania Press, 2003), p.78.

[7] P. Elman, “The Economic Causes of the Expulsion of the Jews in 1290” The Economic History Review, 7:2(1937) 145-154 (p.145).

[8] “The Jews of England in the Thirteenth Century,” Jewish Quarterly Review, 15:1 (1902), 5-22 (p.10).

[9] Ibid, p.11.

[10] B. L. Abrahams, “The Expulsion of the Jews from England in 1290” Jewish Quarterly Review, 7:1 (1894), 75-100 (p.84).

[11] Johnson, A History of the Jews, p.205.

[12] Ibid, p.208.

[13] “The Jews of England in the Thirteenth Century,” Jewish Quarterly Review, 15:1 (1902), 5-22 (p.10).

[14] R. W. Dorin, “‘Once the Jews have been Expelled:’ Intent and Interpretation in late Medieval Canon Law.” Law and History Review, May 2016, Vol. 34, No. 2., 335-362.

Brook would presumably have us glorify the Rothschilds, as did former inside trader

Brook would presumably have us glorify the Rothschilds, as did former inside trader